Median home prices are near an all-time high in Bend. The inventory of homes for sale skews strongly toward a “seller’s market.” Interest rates have risen from their historic lows of recent years.

Median home prices are near an all-time high in Bend. The inventory of homes for sale skews strongly toward a “seller’s market.” Interest rates have risen from their historic lows of recent years.

It seems as if there might be some credible arguments for why now is not the right time to buy a home in Bend, Oregon. Based on historical trends and the state of the market, however, there is powerful evidence that says this is, in fact, a smart time to buy.

One of the strongest pieces of evidence remains the historical trend of appreciation. Over many decades, homes have shown a pattern of increasing in value.

Yes, we could at any time experience a repeat of the implosion of the housing market that we saw 10 years ago. Even accounting for that period, though, the historical average annual appreciation rate of homes over the last 43 years is 4.82 percent, according to data from The W Group, a mortgage company based in Portland.

In its Real Estate Report Card for Deschutes County, The W Group forecasts appreciation of 4.78 percent in the next year and 18.03 percent over the next five years.

Those forecasts are lower than the historical average but include property outside Bend, so it probably understates what we can expect the Bend market to do.

May’s median sales price, for example, was 9.5 percent higher than the same month the year before. Bend’s year-to-date median sales price through May of $415,000 is 9.2 percent higher than the same figure from a year ago. Even before the summer season, the year-to-date median price through May is already 4.0 percent higher than last year’s end-of-year median sales price.

Income, jobs support healthy market

According to The W Group, the median household income in Deschutes County is $67,000. Combined with data from home prices, interest rates, wage growth and jobs, that income level produces an “affordability index” of less than 100, which says a household earning the median income can afford the payments on a median-priced home (assuming 20 percent down).

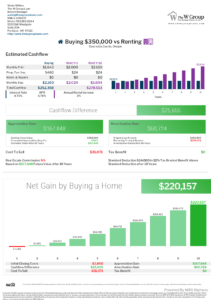

The W Group marshals evidence to show that the alternative to buying – renting – costs more in the long run. For its Deschutes County report card, The W Group compares the purchase of a $350,000 home (with a monthly principle, interest, taxes and insurance payment of $2,103) with a rental starting at $2,000 monthly and increasing 3 percent annually.

After 10 years, The W Group calculates that buying a home would produce a net gain of $220,000 (including appreciation and the amortization of the loan) compared with renting.

The W Group can’t quantify other aspects of home ownership, such as the ability to plant roots and to turn four walls and a roof into the place where a family’s life unfolds. If you are in the market for a home, I am confident that I can deliver an outcome that will exceed your expectations. Or, if you’re thinking about selling, my knowledge of the market and experience in Bend real estate will come to bear as you sell your home. Please contact me at (541) 383-1426 or visit Bend Property Search to connect with me through my website.